By: Kerri N. Kramer and Isabelle Chau

Implementing better recordkeeping is not only good business practice, but can also mitigate future litigation burdens and costs. In the event of a lawsuit, an employer may be required to produce employment-related records, including personnel, payroll, and/or timekeeping records. Failure to do so can lead to fines and other adverse actions.

In addition, it is important to remember that employers have long been subject to several mandatory recordkeeping and production requirements under state and federal law. In addition, the California Supreme Court recently held, in Donohue v. AMN Services, LLC (2021) 11 Cal. 5th 58, that “[i]f an employer’s records show no meal period for a given shift over five hours, a rebuttable presumption arises that the employee was not relieved of duty and no meal was provided.” Id. at 74. It is then the employer’s burden to rebut this presumption by showing that a compliant meal period was properly provided, even though it was apparently not properly taken and/or recorded by the employee. The Court specifically observed that the rebuttable presumption derives from an employer’s duty to maintain accurate records of meal periods. Id. at 76. This burden can increase the risks and costs of litigation for employers and highlights the importance of (1) maintaining compliant, accurate time records; and (2) maintaining records necessary to overcome the presumptions that arise in the face of apparent violations.

These records can be crucial for demonstrating compliance in litigation, arbitration, and/or government agency audits. Therefore, in light of both applicable legal requirements and practical considerations, it is critical for employers to maintain accurate, compliant records in a manner and/or system that allows for prompt retrieval of requested records, including for specific employees and/or time periods.

As such, this article contains a summary of the various recordkeeping requirements with which employers must comply under California and federal law.

TIMEKEEPING & PAYROLL

Federal Law

The Fair Labor Standards Act (FLSA) requires employers to maintain accurate records of hours worked by nonexempt employees.

The FLSA also requires the following information to be accurately retained by the employer for each non-exempt employee:

- Full name;

- Social Security number;

- Address, including zip code;

- Birth date (if younger than 19 years old);

- Sex;

- Occupation;

- Time and day of week when employee’s workweek begins;

- Hours worked each day;

- Total hours worked each workweek;

- Basis on which the employee’s wages are paid (e.g., “$9 per hour,” “$440 a week,” “piecework”);

- Regular rate of pay (for any workweek in which overtime hours were worked);

- Total daily or weekly straight-time earnings;

- Total overtime earnings for the workweek;

- All additions to or deductions from the employee’s wages;

- Total wages paid each pay period; and

- Date of payment and the pay period covered by the payment.

The FLSA does not require employers to use time clocks, timecards, or any other specific timekeeping system. As such, employers may use any timekeeping method they choose. For example, they may use a manual or electronic time clock, employ a designated timekeeper to track employees’ work hours, or ensure that workers write their own times on their timecards. Any timekeeping plan is acceptable, so long as it is complete and accurate.

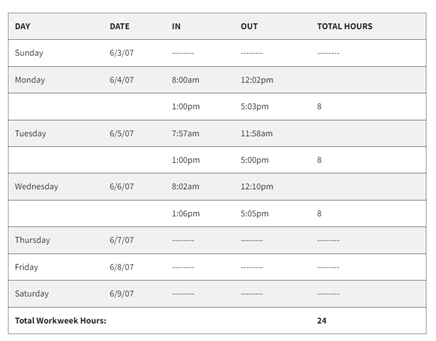

The Department of Labor (DOL) provides, but does not require, the following sample timekeeping format:

Under the FLSA, employers must preserve payroll records for at least three years. Records on which wage computations are based (such as timecards and piece work tickets, wage rate tables, work and time schedules) and records of additions to or deductions from wages should be retained for at least two years. See 29 CFR Part 516.6.

The records may be kept at the place of employment or in a central records office. However, these records must be open for inspection with only 72 hours’ notice by the DOL’s Wage and Hour Division representatives. Because this turnaround time is so quick, it is imperative that employers have good record-keeping practices in place before an investigation.

California Law

The Industrial Welfare Commission Wage Orders require that California employers keep “[t]ime records showing when the employee begins and ends each work period. Meal periods, split shift intervals and total daily hours worked shall also be recorded.” See, for example, IWC Wage Order 16-2001(6)(A)(1), the Wage Order applicable to the Construction industry.[1] The Wage Orders also requires employers to keep accurate information of total hours worked during the payroll period and applicable rates of pay.

Section 6 of IWC Wage Order 16-2001 provides in full as follows:

Records

(A) Every employer who has control over wages, hours, or working conditions shall keep accurate information with respect to each employee, including the following:

(1) The employee’s full name, home address, occupation, and social security number. The employee’s date of birth, if under 18 years of age, and designation as a minor. Time records showing when the employee begins and ends each work period. Meal periods, split shift intervals, and total daily hours worked shall also be recorded. Meal periods during which operations cease and authorized rest periods need not be recorded.

(2) Total wages paid each payroll period, including value of board, lodging, or other compensation actually furnished to the employee.

(3) Total hours worked during the payroll period and applicable rates of pay. This information shall be made readily available to the employee upon reasonable request. When a piece rate or incentive plan is in operation, piece rates or an explanation of the incentive plan formula shall be provided to employees. An accurate production record shall be maintained by the employer.

(B) Every employer who has control over wages, hours, or working conditions shall semimonthly or at the time of each payment of wages furnish each employee an itemized statement in writing showing: (1) all deductions; (2) the inclusive dates of the period for which the employee is paid; (3) the name of the employee or the employee’s social security number; and (4) the name of the employer, provided all deductions made on written orders of the employee may be aggregated and shown as one item. (See Labor Code Section 226.) This information shall be furnished either separately or as a detachable part of the check, draft, or voucher paying the employee’s wages.

(C) All required records shall be in the English language and in ink or other indelible form, dated properly, showing month, day and year. The employer who has control over wages, hours, or working conditions shall also keep said records on file at the place of employment or at a central location for at least three years. An employee’s records shall be available for inspection by the employee upon reasonable request.

(D) Employers performing work on public works projects should refer to Labor Code Section 1776 for additional payroll reporting requirements.

California employers are also required to retain copies of itemized wage statements issued to employees (or other records reflecting the same categories of information). As a reminder, Labor Code § 226 requires itemized wage statements to accurately reflect all of the following information: (1) gross wages earned, (2) total hours worked, (3) the number of piece-rate units earned and any applicable piece rate, if the employee is paid on a piece-rate basis, (4) all deductions, (5) net wages earned, (6) the inclusive dates of the pay period, (7) the name of the employee and only the last four digits of their social security number or an employee identification number other than a social security number, (8) the name and address of the legal entity that is the employer, and (9) all applicable hourly rates in effect during the pay period and the corresponding number of hours worked at each hourly rate by the employee. Additional requirements apply for farm labor contractors, temporary services employers, and employees paid, in whole or in part, on a piece rate basis.

State law requires payroll records to be kept for at least three years either at a central location within the state or at the plants/establishments where the employees are employed. Labor Code § 1174(d). An employer who receives a written or oral request from a current or former employee to inspect or copy their payroll records shall comply with the request as soon as practicable, but no later than 21 calendar days from the date of the employer’s receipt of the request.

Employers are reminded that they should not rely solely upon third parties, such as payroll processors or providers, to retain copies of these records. Contrary to popular belief, these vendors often do not retain employer’s records for the entire retention period, if at all. Employers are ultimately responsible for compliance and should ensure that this duty is upheld.

PERSONNEL RECORDS

Effective January 1, 2022, California employers must now preserve personnel records for a minimum of four years, and possibly longer if a Fair Employment and Housing Act (FEHA) complaint has been filed. This means records must be kept at least four years from the date of creation and four years from the date of termination of an employee or non-hire of an applicant. Although there are some exceptions to allow for records to be kept for a shorter time, it is generally best practice for employers to document and retain records on employees for a minimum of four years.

EMPLOYMENT AUTHORIZATION RECORDS (FORM I-9)

All employers must properly complete Form I-9 for each individual they hire for employment in the United States. This includes citizens and noncitizens. Both employees and employers (or authorized representatives of the employer) must complete the form.

I-9 forms must be stored in their own folder, separate from an employee’s personnel file.

I-9s must be retained – in appropriate paper or electronic format – for a period of at least three years from the first day of employment or one year from the date employment ends, whichever is longer. 8 C.F.R. § 274a.2(b)(3)

Employers are provided at least three business days’ notice of an inspection. They must then be prepared to produce all Form I-9s during the inspection. Id.

OTHER RECORDS

Paystubs

Section 226(a) requires that employers keep a copy of the pay stubs for “at least three years.” As mentioned above, because the statute of limitations for labor code violations can – in effect – extend back four years, many employers retain these records for at least four-year period.

Workers Compensation or Injury Records

An employee’s Workers Compensation records and injury records should be retained for 5 years from latest date of injury or date of compensation last provided. These records should be stored in their own folder, separate from an employee’s personnel file, due to their confidential nature.

Practical Considerations

Below is a table that provides a brief summary of the above-described retention periods and production deadlines for each type of key employment records:

| Type of Record | Minimum Retention Requirement | Production Deadline |

| FLSA Records | 3 years | 72 hours |

| Form I-9 | 3 years after the date of hire or for one year after employment is terminated, whichever is later. | 3 business days |

| Personnel File | 4 years | 30 days |

| Paystubs | 3 years | 21 days |

| Employee Benefits Data | 6 years (but not less than 1 year following a plan termination) |

Check Applicable Benefits Plan |

| Workers Compensation or Injury Records | 5 years from latest of date of injury or date of compensation last provided |

N/A |

As detailed above, it is critical to have appropriate record retention policies in place that ensure each type of employment record is properly maintained, in a manner that allows for production within the applicable deadline.

Even if an employer has these policies in place, the policies are only effective if managers and supervisors are trained on, and properly carry out these policies. Records are essential to help refresh an employee’s memories of an event, establish defenses, and mitigate litigation costs.

We encourage you to reach out for legal guidance if you are uncertain about your record-keeping procedures or how to improve them. It could save your business potential losses and legal consequences in the future.

Kerri N. Kramer is a Senior Associate of Kring & Chung, LLP. She can be reached at (949) 261-7000 or [email protected]. Isabelle Chau is a law clerk at the Firm.

[1] Wage Orders are different depending on the industry. Please visit the following website to find your industry’s Wage Order: (https://www.dir.ca.gov/dlse/whichiwcorderclassifications.pdf)